Powered Land for AI Data Centers

Generative AI use is exploding, creating huge demand for computing power and big opportunities to meet that demand

The Stakes

Over the past year, the talk of the town has shifted from $10 billion compute clusters to $100 billion clusters to trillion-dollar clusters. Every six months another zero is added to the boardroom plans.

Behind the scenes, there’s a fierce scramble to secure every power contract still available for the rest of the decade, every voltage transformer that can possibly be procured. American big business is gearing up to pour

By the end of the decade, American electricity production will have grown tens of percent; from the shale fields of Pennsylvania to the solar farms of Nevada, hundreds of millions of GPUs will hum. The AGI race has begun.

– Leopold Aschenbrenner, former OpenAI researcher, June 2024. For more detail on the scenario read:

Demand for Compute Power: Through the Roof

Nvidia, OpenAI, Anthropic and Google execs meet with White House to talk AI energy and data centers

Data centers set to spike U.S. electricity demand

The Key Bottleneck: Grid Congestion

Competition for Capacity

Hyperscalers are fiercely competing to secure available megawatts. They are reopening older power plants and seeking new capacity, but this surge is causing a shortage of generation and transmission.

Persistent Issue

Adding more capacity is like widening a highway: it just invites more traffic by inducing latent demand. This will happen with compute as well as more capable model find more applications. So chronic electricity supply issues are to be expected.

Shortfall

This intense competition highlights a critical shortfall in power capacity. This presents a unique opportunity for companies that can provide reliable, cost-effective power solutions.

The Opportunity: Powered, Lit Land

Strategic Locations

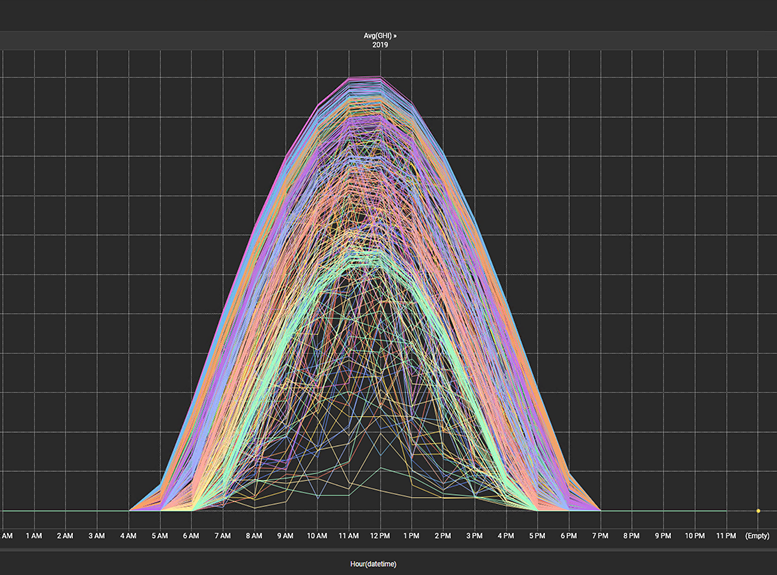

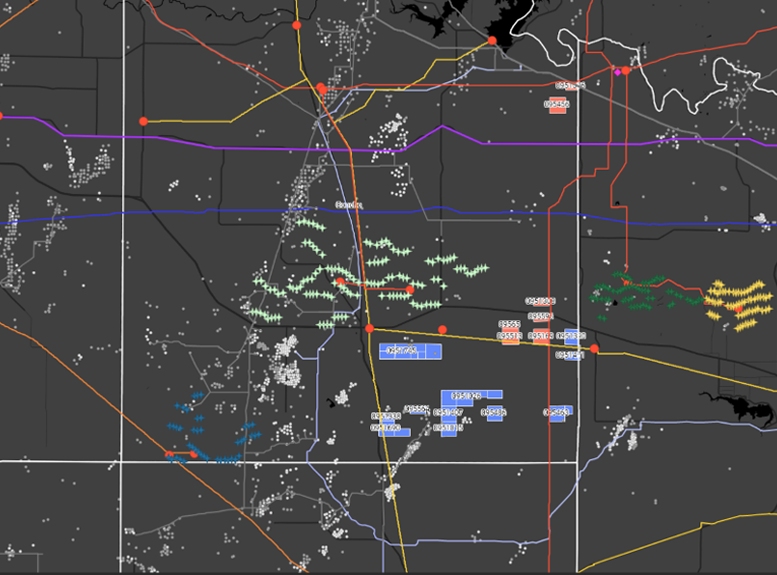

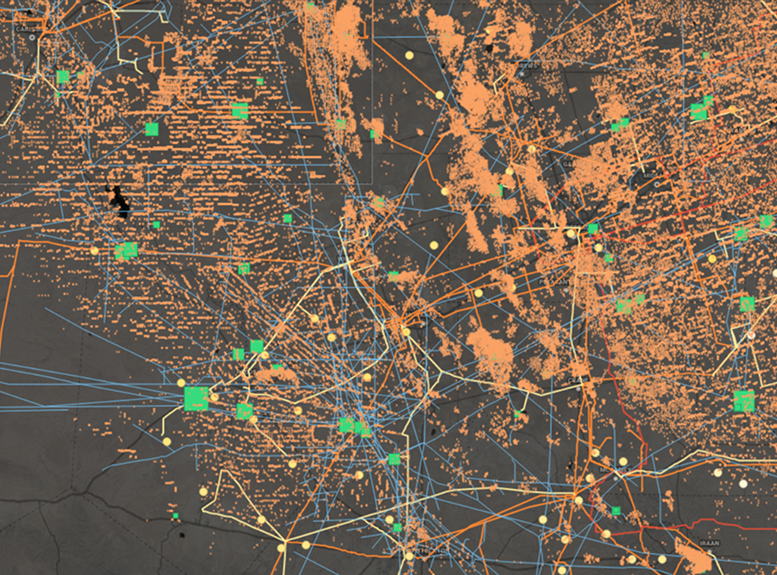

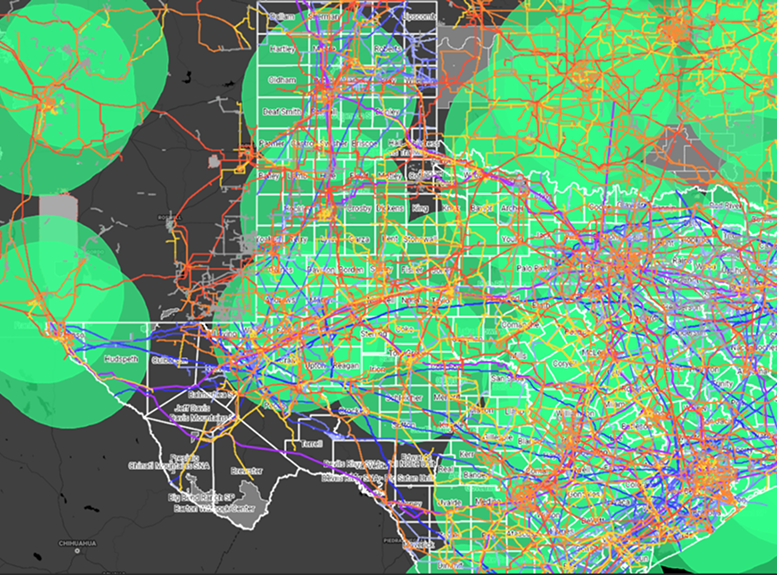

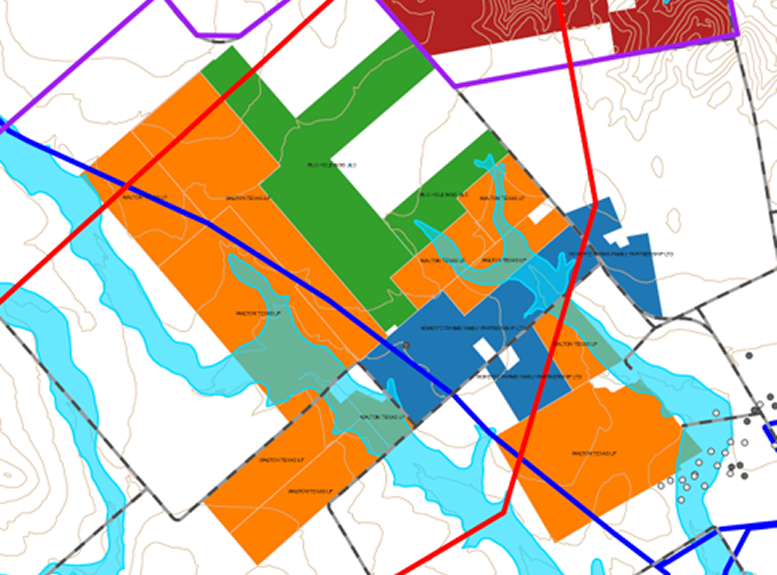

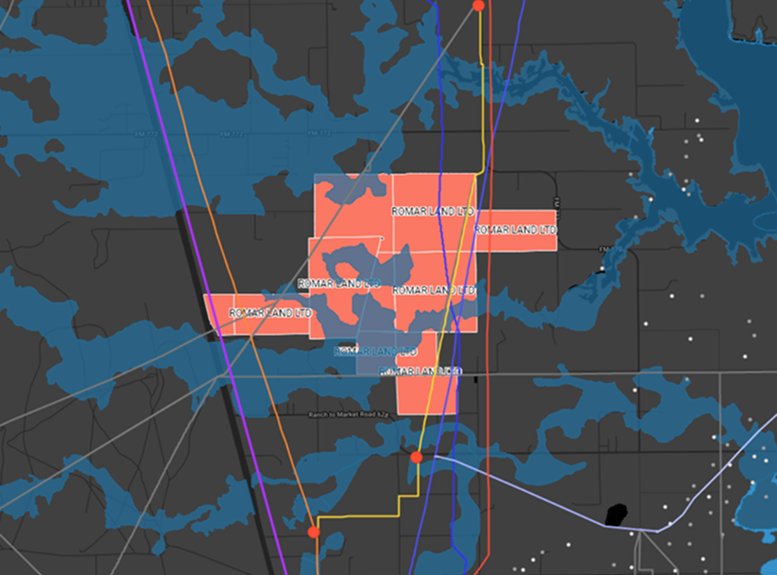

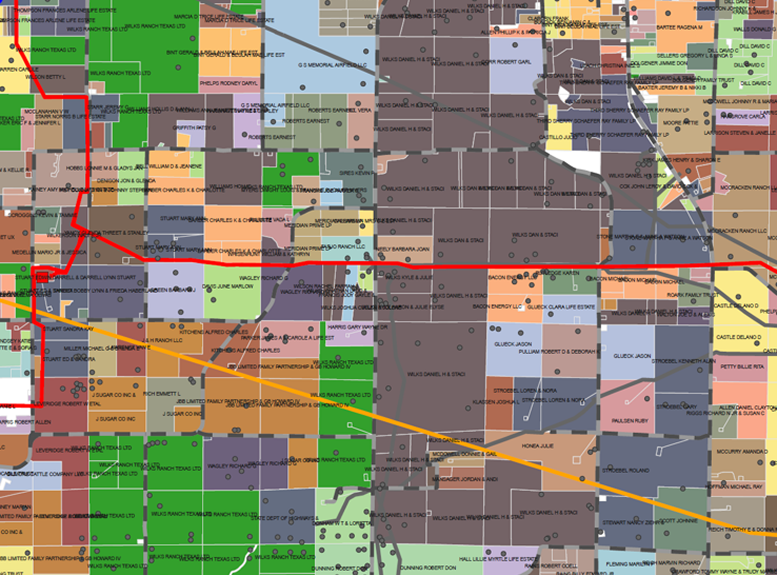

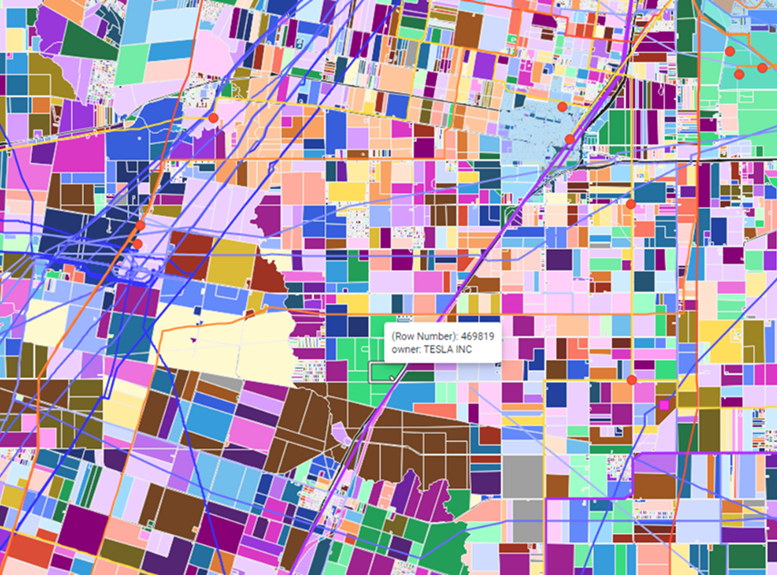

Choose data center campus sites that are strategically located near abundant power sources, specifically solar and natural gas, and backbone fiber networks.

Build Co-Located Power

This approach minimizes our reliance on the electric grid and eliminates the need for expensive grid upgrades. A grid connection is optional and can come well after initial project completion for faster data center delivery times.

Competitive Advantage

We gain a significant competitive edge by building the power generation on-site, behind the meter (called a microgrid or power island), avoiding the fierce competition for public grid-based megawatts and securing access to reliable, cost-effective energy.

Strategy Overview

Lock the Dirt

Secure strategically located parcels of land.

De-Risk the Megawatts

Run interconnection studies, air-quality permitting, on-site power partnership, and county approvals up front so our first megawatts are available faster than utility power.

Multiple Monetization Paths

Design each site so it can pivot. Ground-lease to a hyperscaler, JV with a colo REIT, or evolve into a self-operated campus, whichever offers the best risk-adjusted return.

Energy and Land Prospecting Experts

We are experts in data systems and analytics having built these tools for the energy industry for over 10 years.

We’ve built a prospecting tool for in-house evaluations, giving us a faster decision loop.